Introduction

Often hailed as “Digital Gold,” Bitcoin has progressively garnered attention and recognition since its creation in 2009 by the mysterious entity, Satoshi Nakamoto. Positioned as a digital alternative to the traditional store of value, physical gold, Bitcoin’s journey has been characterized by a primary uptrend, prompting a closer examination of its intrinsic value and use cases

Bitcoin Halving and Scarcity

A defining feature of Bitcoin’s monetary policy is the halving event, occurring approximately every four years or after every 210,000 blocks. This event, designed to halve miners’ rewards, commenced with the initial mining reward set at 50 BTC per block in 2009. Subsequent halvings, in November 2012 (reducing to 25 BTC) and July 2016 (further reducing to 12.5 BTC), contribute to Bitcoin’s scarcity. The latest halving in May 2020 brought the reward down to 6.25 BTC per block, ensuring a capped total supply of 21 million—a key aspect of Bitcoin’s deflationary nature which is expected to be completed in the year 2140.

Discussing its recent positive performance, CNBC declared Bitcoin (BTC) could soon be rarer than gold, marking a historic moment for asset scarcity. The Fast Money program emphasized Bitcoin’s potential as it surpassed $42,000 for the first time in over a year. Speculations about a continued surge in its price are fueled by the upcoming halving event, expected to alter the “stock to flow ratio,” making Bitcoin scarcer than gold in relative terms. CNBC’s observations highlight a shift in the availability of mined Bitcoin compared to gold.

Historical Bull Runs

Each Bitcoin halving has been followed by a notable bull run, signifying a surge in Bitcoin’s price that ripples across the entire cryptocurrency market. This pattern, observed after previous halving events, underscores the impact of supply reduction on market dynamics and investor sentiment.

Global Recognition and Adoption

Beyond speculative dynamics, Bitcoin is gaining credibility on the global stage. Notably, countries such as the United States and El Salvador have begun recognizing Bitcoin as a form of national currency, integrating it into their national wealth reserves. This shift signifies a growing acknowledgment of Bitcoin as a legitimate store of value at the national level.

Market Capitalization and Global Ranking

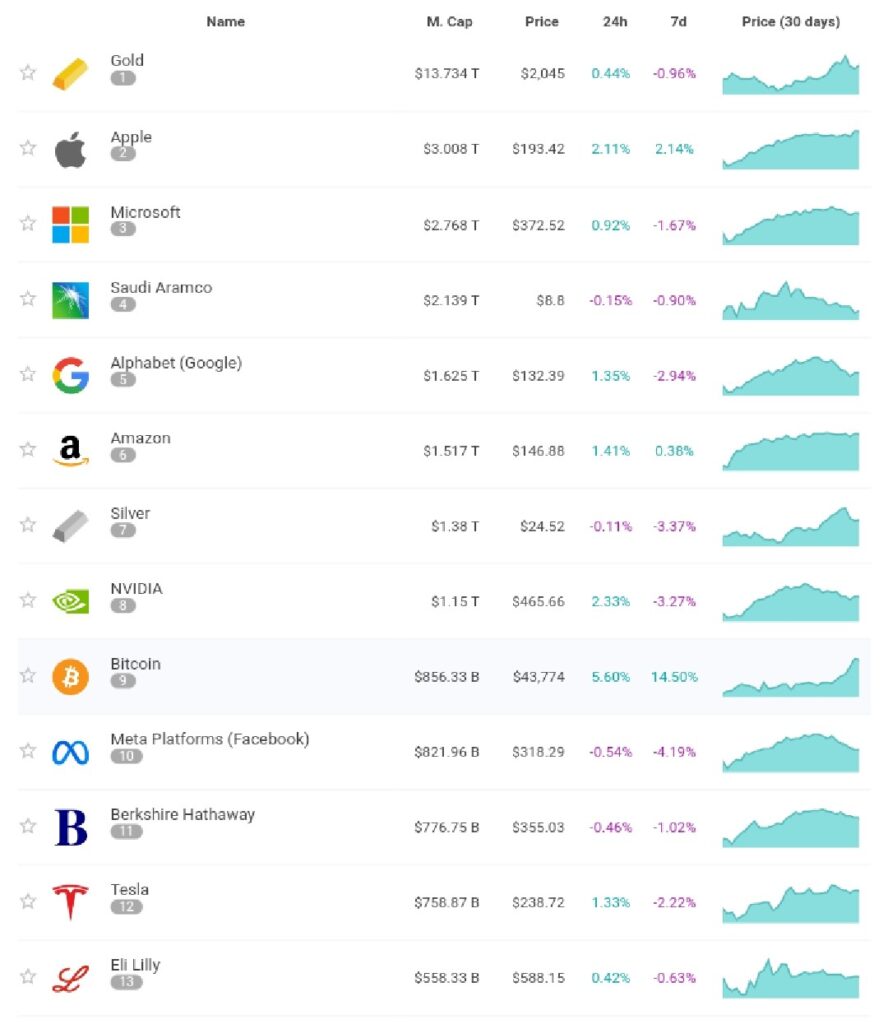

Bitcoin’s market valuation has soared beyond $800 billion, elevating its stature to the 9th rank among global assets, even surpassing Meta and Tesla. This financial ascent signifies Bitcoin’s substantial influence and recognition within the broader financial landscape. Follow this link to see the ranking of global assets

Anticipation and Price Fluctuations

The positive sentiment surrounding Bitcoin Halving is historically linked to anticipation of post-halving rallies. Investors closely watch these events, expecting them to trigger price fluctuations. The correlation between halving events and subsequent price surges has become a notable pattern in the cryptocurrency market.

While historical trends indicate a general increase in Bitcoin prices following halving events, it’s crucial to acknowledge that this pattern is not assured. The increase of prices will hinge on various factors tied to the 2024 Bitcoin Halving, encompassing sustained adoption and other elements influencing demand. Outlined below are the price upswings observed in BTC six months after each halving:

First Halving – November 28, 2012:

On the day of the halving, Bitcoin’s price hovered around $12. By approximately May 28, 2013, the price had experienced a substantial upturn, reaching approximately $130.

Second Halving – July 9, 2016:

Around the halving date, Bitcoin was valued at approximately $660. By January 9, 2017, the price had undergone a noteworthy increase, reaching about $900 within the span of six months.

Third Halving – May 11, 2020:

During the halving event, Bitcoin was valued at roughly $8,600. Six months later, around November 11, 2020, the price surged to over $15,700, indicating a significant appreciation in value.

Conclusion

As Bitcoin continues to assert itself as a digital store of value, the question of whether it is replacing physical gold becomes more pertinent. The halving events, coupled with increasing global recognition and adoption, position Bitcoin as a unique asset with both scarcity and utility. The ongoing evolution of Bitcoin’s role in the global financial landscape invites further exploration into its potential to rival or complement traditional stores of value, such as physical gold.