In the previous bull run, remarkable gains were achieved by those who choose the right altcoins early:

$BNB +30,000%

$DOGE +40,000%

$MATIC +45,000%

$SOL +50,000%

Excited about the possibility of not missing out on potential 500X returns this bull run? Here are 10 guidelines to identify the next promising gems.

1. Continuous Learning:

- Engage in ongoing education within the financial realm through platforms like Binance Academy or Crypto University.

- Stay informed about market trends, technological developments, and regulatory changes to make informed investment decisions, you can follow prominent futures like Grey Jabesi, Ash crypto, and Crypto Rover to stay up to date with all the latest market trends.

2. Token Selection Criteria:

- Avoid tokens with frequent unlocks and a low circulating supply, as an imbalance in supply and demand can lead to price declines.

- Understand the economic principles that govern token prices and the impact of token unlocks on the market.

3. VC Entry Price Comparison:

- Exercise caution when considering tokens where venture capitalists (VCs) or angels have significantly lower entry prices than individual investors.

- Anticipate potential sell-offs by early investors during token unlocks, which may influence the token’s market performance.

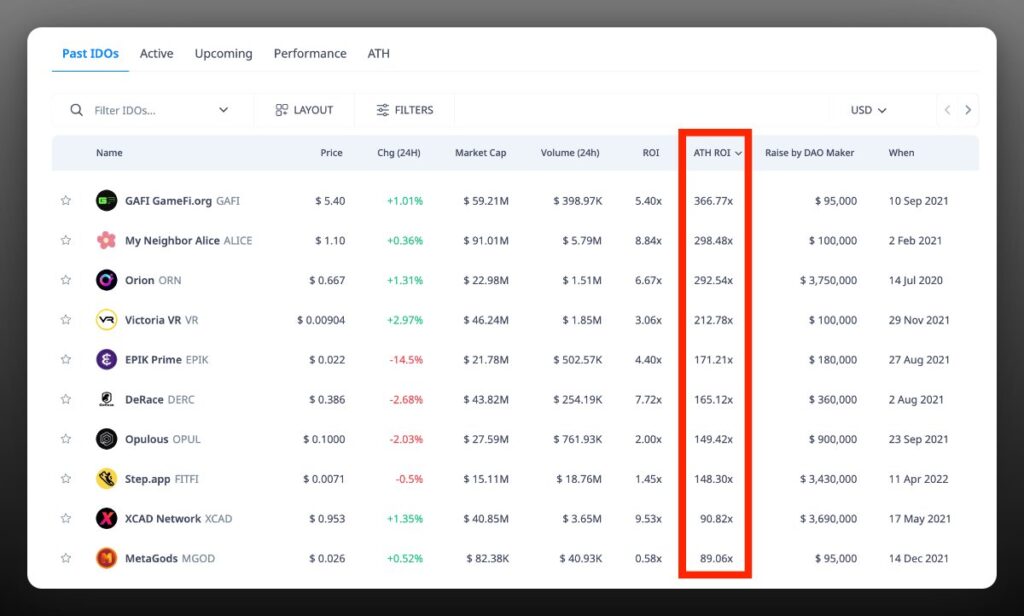

4. Participate in ICOs during Bull Runs:

- During bullish market conditions, consider participating in Initial Coin Offerings (ICOs) before tokens are officially listed.

- Historical examples, such as NEO and ETH, demonstrate the potential for substantial returns from ICO investments.

5. Market Cap Analysis:

- Evaluate a token’s market capitalization in comparison to others, as excessively large market caps, like that of DOGE, may limit potential gains.

- Utilize platforms like CoinGecko to compare tokens and assess their growth potential.

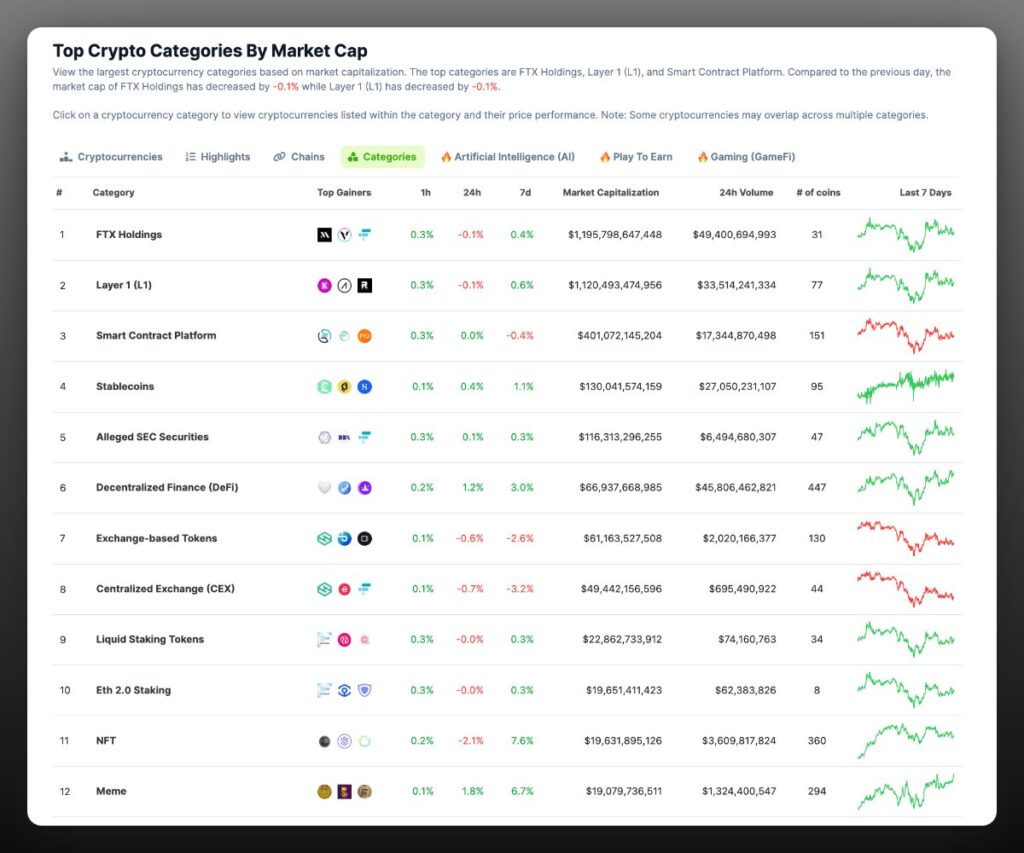

6. Narrative Prediction:

- Anticipate broader market narratives within the cryptocurrency space.

- Align token investments with predicted narratives to capitalize on emerging trends and themes in the crypto ecosystem.

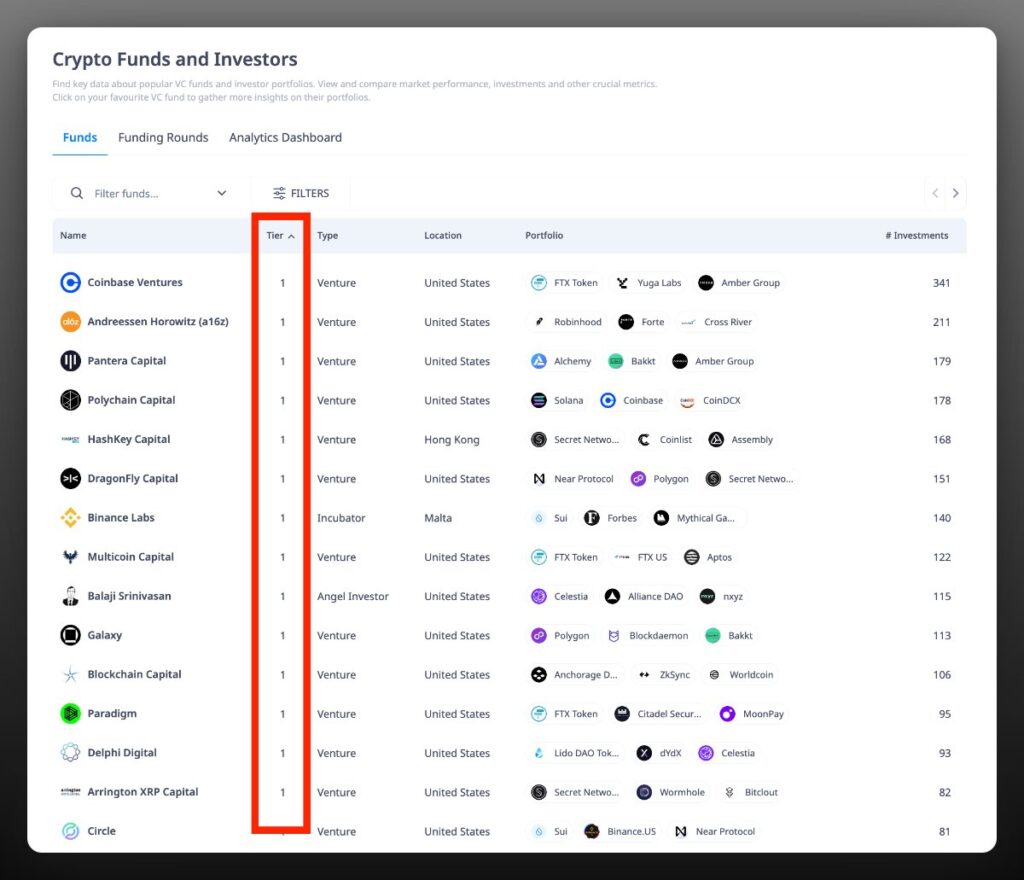

7. VC Influence on Token Prices:

- Assess the influence of venture capitalists on token prices.

- Prioritize tokens backed by Tier 1 VCs, as their involvement can positively impact the project’s credibility and market performance.

You can check the VCs Tier here

8. Avoiding Old Altcoins:

- During a new bull run, focus on emerging altcoins rather than older ones that may have already peaked.

- Recognize that outdated altcoins may have lost market faith and offer limited growth potential.

9. Utility Evaluation:

- Assess the practical value and utility of a token beyond its ticker symbol.

- Confirm the token’s potential for contributing to ecosystem development or community expansion.

10. Price History and Chart Analysis:

- Examine the price history and chart patterns of a token before making investment decisions.

- Tokens with a history of significant pumps and dumps may have lower potential for substantial gains compared to those with a more stable price history.

Blog idea from Rattibha

Conclusion

By following these steps, investors can navigate the cryptocurrency market strategically and approach pumping altcoins with caution due to the volatile nature of cryptocurrencies.