Many analysts and market experts believe that BlackRock and other big financial institutions dump Bitcoin to buy the dip. Is this claim accurate? Additionally, what are the prospects for Spot ETF approval, and how do general market conditions play a role? Explore this article for insights into these questions.

Introduction

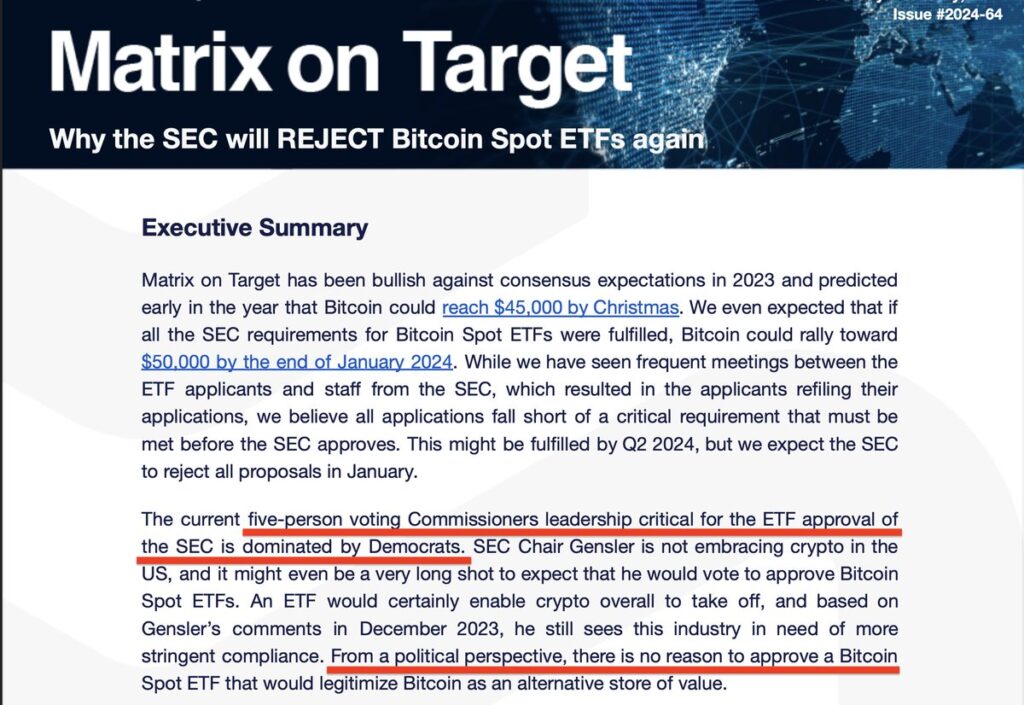

On January 3, 2024, Bitcoin experienced a significant liquidation of over $400 Million in long positions and settling the price at $40,000. This abrupt downturn was fueled by the dissemination of Fear, Uncertainty, and Doubt (FUD) across various news platforms and social media, with headlines suggesting that the SEC might reject the Bitcoin spot ETF application, triggering a panic-induced market sell-off.

Unraveling the 9% Price Drop

The sudden 9% drop in Bitcoin’s value was primarily attributed to the FUD disseminated before a liquidity sweep. Retail traders, gripped by fear, hastily offloaded their holdings to larger institutions.

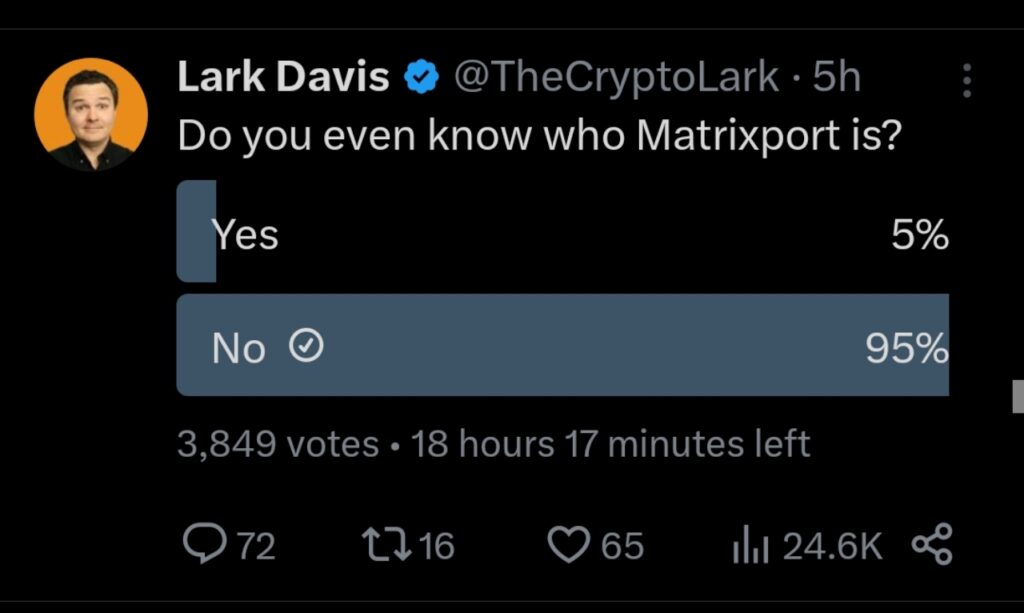

Interestingly, a poll conducted by Lark Davis revealed that a significant portion of the community remains unfamiliar with Matrix, contributing to the prevailing market apprehension.

Insights from Expert Traders

Experts in the field suggest that substantial institutions strategically capitalize on market fears, emphasizing, “Big institutions aim to acquire Bitcoin at a discounted rate before the anticipated market upswing.” This notion underscores a calculated approach to profiting from market fluctuations.

BlackRock’s Involvement

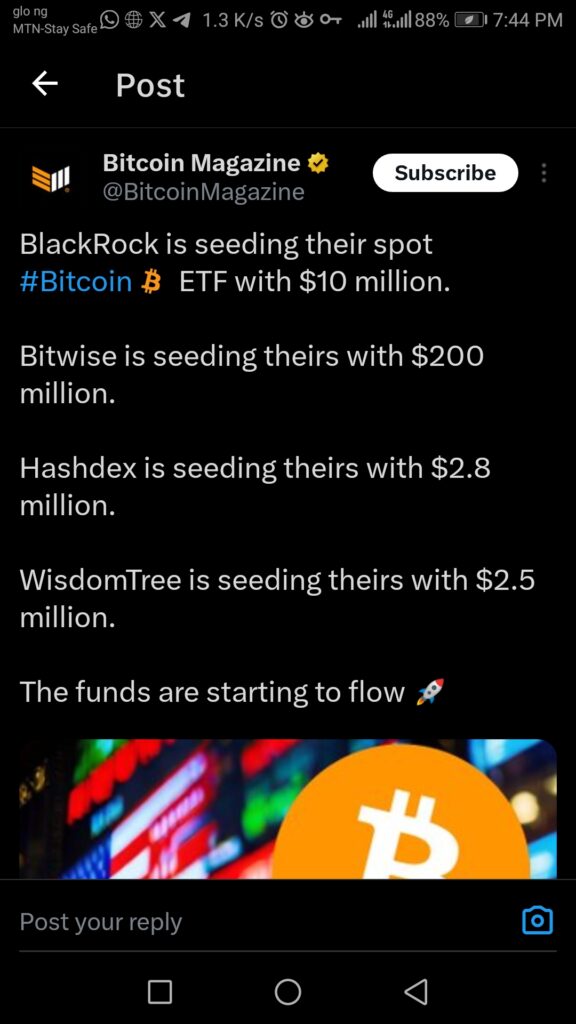

BlackRock, along with other major financial players, has been identified as a significant participant in this market scenario. Reports indicate that they are seeding their Bitcoin spot ETFs with a substantial investment, estimated at $10 million. The seed funds have reportedly saturated the market, prompting speculation about the possibility of another market dip before a subsequent surge.

Conclusion

Navigating the crypto market’s ups and downs requires understanding the complexities at play. While short-term panic may be triggered by FUD, experts highlight a broader strategy among institutional players. BlackRock’s participation adds complexity, with their spot ETF seeding adding an intriguing element. Understanding key players’ motives is crucial for informed decision-making in the ever-evolving crypto landscape.

Disclaimer: This post is intended for educational purposes only and should not be considered financial advice. Importantly, it does not aim to criticize or portray BlackRock negatively; it is solely created for educational purposes.