Bitcoin, the most popular and valuable cryptocurrency, has seen a remarkable recovery in 2023, reaching as high as $47,000 in January after starting the year at around $16,000. This surge was largely driven by the launch of 11 new bitcoin exchange-traded funds (ETFs) in the US, which made it easier and cheaper for investors to access the digital asset.

But is this rally sustainable, or is it a bubble waiting to burst? And more importantly, is this the right time to buy bitcoin, or should you wait for a better opportunity?The answer, as always, depends on your risk appetite, time horizon, and investment goals.

But here are some factors to consider before you make your decision.

The pros of buying bitcoin now

- Bitcoin ETFs Transform the Game: The advent of Bitcoin ETFs has catalyzed increased institutional and retail interest, providing a convenient and secure entry point for investors. This innovation not only diversifies the crypto space but also simplifies exposure to Bitcoin without the complexities of direct coin acquisition.

- Robust Long-Term Potential: Despite market volatility, Bitcoin enthusiasts foresee a promising future as a store of value, medium of exchange, and hedge against inflation. With its limited supply, decentralized network, and widespread adoption, Bitcoin continues to garner support, fostering innovation and development within the crypto community.

- Undervalued Compared to Peak: Despite a robust 2023 rally, Bitcoin remains below its all-time high, leaving room for potential growth. Analysts predict further appreciation, suggesting a potential six-figure value in the coming years based on metrics like the stock-to-flow ratio and adoption curve.

The Cons of Buying Bitcoin Now

- Extreme Volatility and Risk: Bitcoin’s notorious price swings pose a challenge for investors, requiring a high tolerance for risk and a long-term perspective. Unpredictable factors, including news, sentiment, and regulatory changes, contribute to the cryptocurrency’s inherent volatility.

- Challenges and Uncertainties: Bitcoin faces hurdles like scalability, environmental concerns, regulatory scrutiny, and competition from other cryptocurrencies. The evolving landscape introduces uncertainties that may impact its growth and relevance in the future.

- No Guarantees – A Speculative Venture: Despite Bitcoin’s resilience, it remains an experimental project with no assured success. Influenced by user behavior, expectations, and external factors, Bitcoin’s value is contingent on market dynamics, lacking backing from physical assets or entities.

Bitcoin Price Manipulation Uncovered

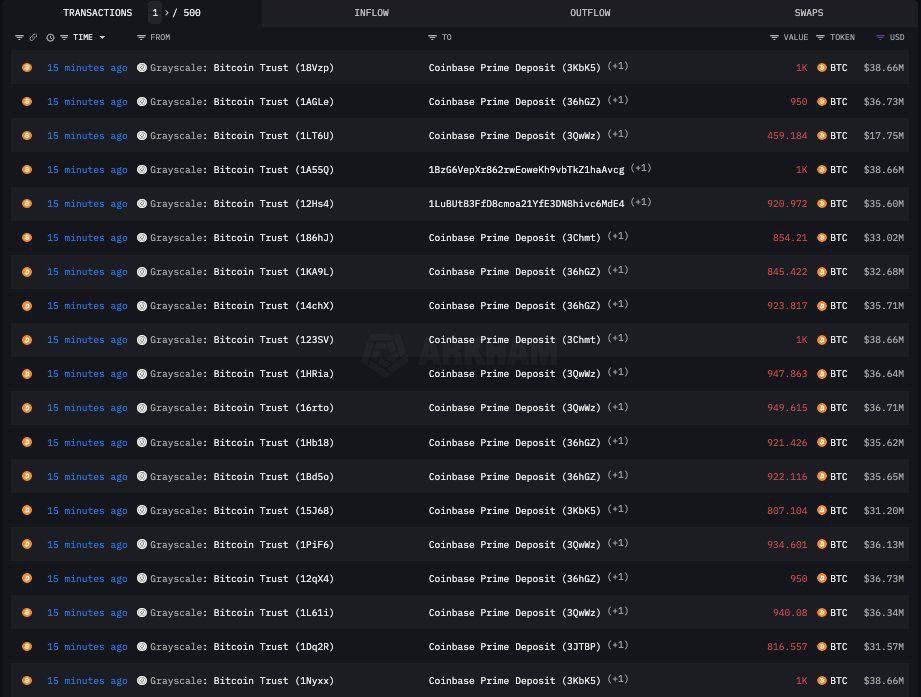

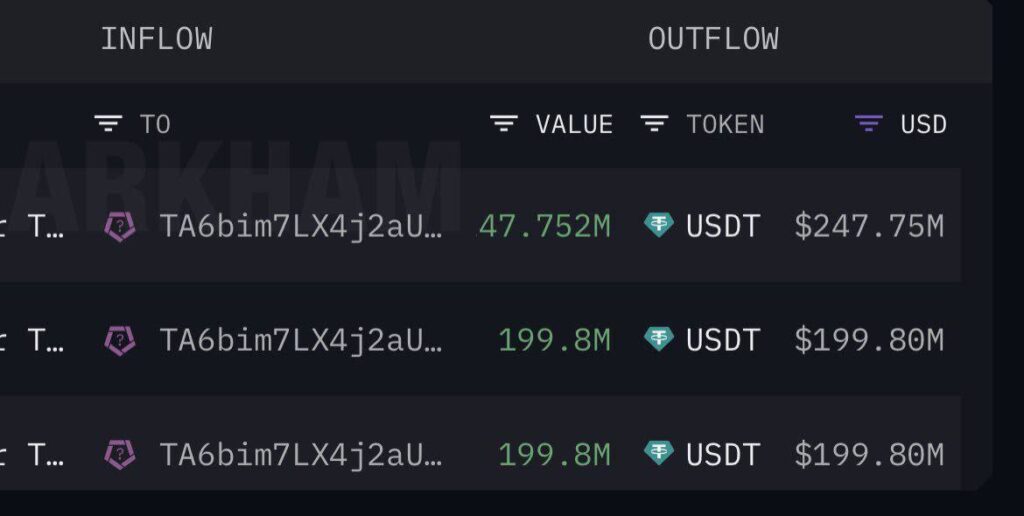

Recent revelations expose a concerning scenario: $647.1M withdrawn from GBTC coincides with Tether printing the same amount on Tron. Allegedly destined for controversial figure Justin Sun for a Bitcoin purchase, this manipulation, coupled with Wall Street’s ETF drama, paints a precarious picture for the crypto market. Amidst these challenges, it’s crucial to acknowledge reality, exercise prudent profit-taking strategies, and refrain from investing more than one can afford to lose.

The Bottom Line

Bitcoin offers a unique and potentially lucrative opportunity, but it demands careful consideration. Before diving in, conduct thorough research, assess risk tolerance, and understand the market’s unpredictability. Bitcoin isn’t a get-rich-quick scheme but a long-term, speculative venture. Approach investment in this ever-evolving space with wisdom and responsibility. Stay informed and invest wisely!

Disclaimer: This post is intended for educational purposes only and should not be considered financial advice.