The recent delay by the U.S. Securities and Exchange Commission (SEC) in approving BlackRock’s Ethereum (ETH) exchange-traded fund (ETF) proposal has left many in the crypto community wondering when these investment products will finally see the light of day. As the SEC applies caution to ETH ETFs, market analysts are weighing in on the factors influencing this decision and the potential timeline for approval.

The SEC’s Stance and Market Predictions

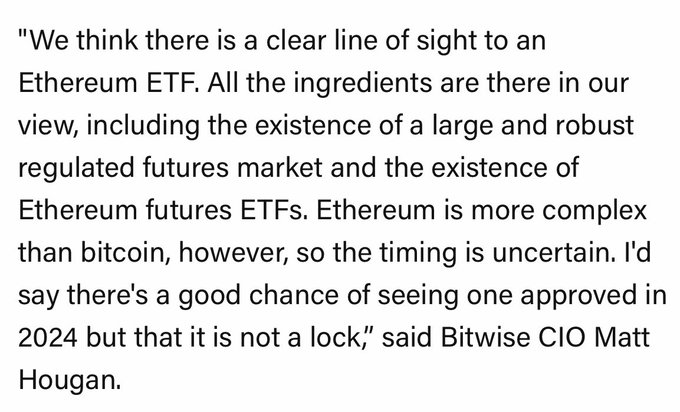

The SEC’s decision to extend the review period for ETH ETF proposals was widely anticipated. A JP Morgan analyst and Bloomberg’s ETF expert both expressed skepticism about the SEC approving an ETH-based ETF by May, giving it no more than a 50% chance. This cautious approach echoes the SEC’s historical hesitancy in approving bitcoin funds due to concerns about market manipulation.

Learning from Bitcoin ETFs:

The approval of bitcoin ETFs followed a prolonged period of SEC scrutiny and concerns about market manipulation. BlackRock, a major player in the ETF space, implemented an exchange surveillance protocol to address these fears. Grayscale’s court victory also played a crucial role in pressuring the SEC to reconsider its listing standards, ultimately leading to the approval of bitcoin-based financial products.

While ETH futures ETFs are already live, SEC Chairman Gary Gensler has emphasized that this does not signal a willingness to approve listing standards for crypto asset securities. SEC Commissioner Hester Peirce, a pro-crypto regulator, acknowledges the complexity of the decision-making process and emphasizes the importance of precedent. Peirce criticizes the SEC’s past delays, stating that it has “squandered a decade of opportunities” in the crypto space.

Challenges for ETH ETF Approval

Unlike bitcoin, which regulators uniformly classify as a commodity, Ethereum’s classification is less clear. Gensler has raised concerns over ETH’s decentralization, especially after the shift to a staking mechanism. Ongoing SEC lawsuits against crypto exchanges offering staking services for proof-of-stake blockchains, including Ethereum, add to the complexity. The potential classification of ETH as a commodity may also involve the Commodity Futures Trading Commission, creating regulatory challenges.

Investor Interest and Ethereum’s Unique Features

Despite the regulatory hurdles, investor interest in ETH remains strong. Ethereum 2.0, with its promise of faster transactions and lower fees, contributes to this enthusiasm. The switch to a proof-of-stake mechanism makes Ethereum more appealing for investors, allowing them to stake for profit. These factors, combined with the anticipation of positive news, has a potential to create a trajectory that could lead to increased staking yields and price appreciation.

Conclusion

While ETH ETFs appear inevitable, navigating the regulatory landscape remains a complex journey. The SEC’s cautious approach, coupled with ongoing legal challenges and the classification debate, introduces uncertainty. However, Ethereum’s unique features and investor interest suggest that the eventual approval of ETH ETFs could bring significant benefits to both the crypto community and mainstream investors. As the market eagerly awaits regulatory clarity, the road to ETH ETF approval continues to unfold.