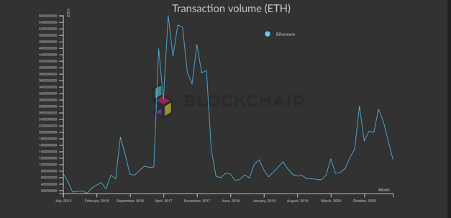

As we have seen, the transaction volume of Ethereum this bull run is nothing in comparison to the last bull run. Furthermore, the transaction volume seems to have reached a plateau during February 2021, during the same time there was a rise in the popularity of the Binance Smart Chain through exchanges such as Pancake Swap.

According to a report by DappRadar, Binance Smart chain has overtook Ethereum in terms of daily unique active wallets by holding 105,000 with Ethereum being 75,000 respectively. It is quite clear that the tide has changed as more and more developers of decentralized applications have begun moving to the Binance Smart Chain due to the higher fees on the network. It is the question on whether the fact that Ethereum is decentralized is “worth” paying enormously higher fees for.

Furthermore, due to Binance’s loyal community and its ecosystem of the:

· Exchange

· ICO Launchpad

· Binance Chain Wallet (Which allows Direct Wallet deposits from Exchange Spot Wallet)

These factors have led to the Binance Smart chain becoming as popular as ever and reaching an all-time high of around $600.

What does Ethereum have to say to this?

In order to combat the massive issue of high fees and scalability before the ETH 2.0 upgrade, the Ethereum team has scheduled a “Berlin Upgrade” which was scheduled to take place between the 14th and 15th of April and lead to lower gas fees.

The success of Ethereum will largely fall down to this upgrade, as the Binance Smart Chain becomes ever more popular month to month.

How can you get into Blockchain?

Still not a Crypto University student? Join us and secure your spot in the digital future here.

Due Diligence

Any advice or information in this publication is general advice only – it does not take into account your personal circumstances. Please do not trade or invest based solely on this information. By viewing any material or using the information within this publication you understand that this is general education material and you can not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here. Trading cryptocurrency has potential rewards, but also potential risks. You must be aware of the risks and be willing to accept them in order to invest in the markets. Only trade with funds you can afford to lose. This publication is neither a solicitation nor an offer to buy/sell cryptocurrency or other financial assets. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Written by Rodrick Chattaika © Crypto University 2021