Introduction

Morgan Stanley’s recent report has ignited discussions on the potential threat to the U.S. dollar’s dominance in the international financial arena. Geopolitical shifts and the growing twin deficits in the United States have prompted considerations of alternatives to the dollar. This shift has led to the rise of cryptocurrencies, particularly bitcoin and stablecoins, as well as the emergence of central bank digital currencies (CBDCs).

Morgan Stanley’s Insights

According to Andrew Peel, Morgan Stanley’s head of digital asset markets, U.S. monetary policy and economic sanctions have driven some countries to explore alternatives to the dollar. This has fueled interest in digital assets like bitcoin, stablecoins, and CBDCs. The report highlights a clear shift toward reducing dollar-dependency, simultaneously acknowledging the potential of digital currencies to reshape the currency landscape.

Stablecoins and Dollar Reinforcement

Peel also emphasizes the importance of stablecoins pegged to the U.S. dollar. Contrary to eroding the dollar’s dominance, these stablecoins may actually reinforce the need for the fiat currency. Their growing acceptance by mainstream financial entities signals their potential to alter the global finance landscape and solidify the dollar’s position.

CBDCs and Cross-Border Payments

As stablecoins gain traction, the spotlight shifts to CBDCs. These digital currencies have the potential to establish a unified standard for cross-border payments, potentially diminishing reliance on intermediaries like SWIFT and dominant currencies such as the dollar. The report suggests that as CBDCs evolve technologically and gain broader acceptance, they could significantly impact global finance.

Reference: CoinDesk

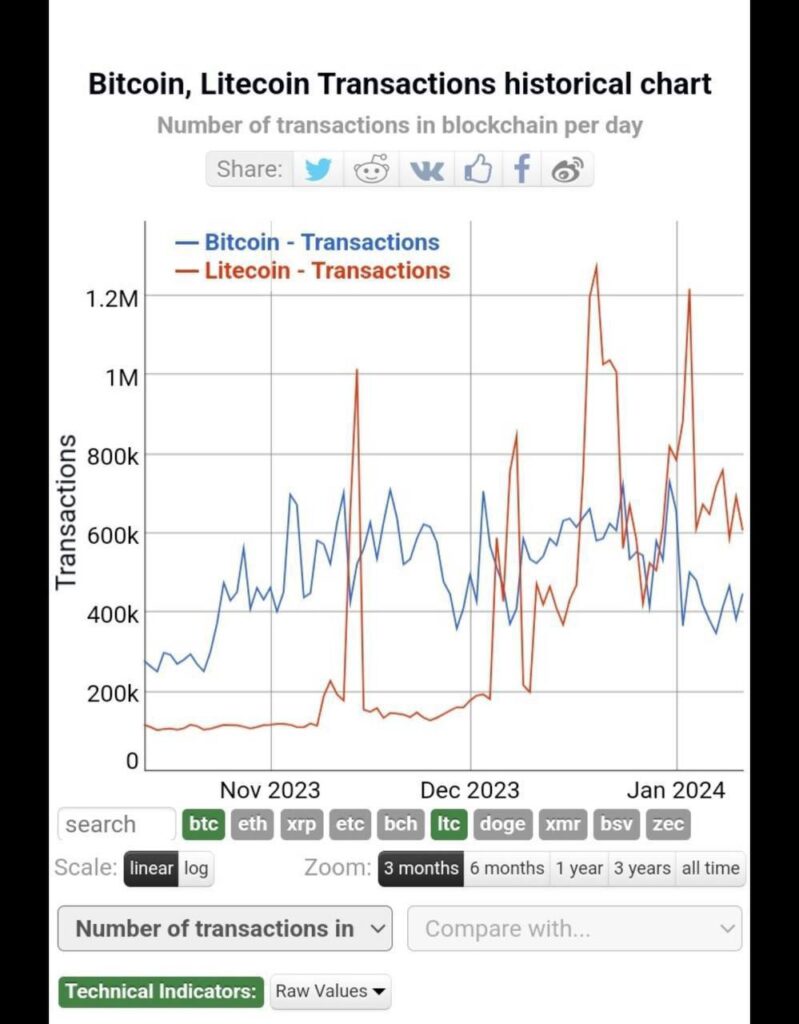

Litecoin’s Impressive Growth

In the midst of these discussions, Litecoin has emerged as a noteworthy player. With over 10 million transactions processed in the first two weeks of 2024, Litecoin has become a leading proof-of-work coin for on-chain transactions. Its popularity on the BitPay payment gateway, surpassing both BTC and ETH combined, underscores the growing influence of cryptocurrencies in everyday transactions.

Conclusion

Morgan Stanley’s analysis and recent market developments suggest that the U.S. dollar’s dominance is facing challenges from various fronts, including cryptocurrencies. While stablecoins may emphasize the need for the fiat currency, CBDCs and the remarkable growth of coins like Litecoin indicate a potential shift in the global financial order. As the world navigates these uncertainties, the interplay between traditional fiat currencies and emerging digital assets will continue to shape the future of global finance.