Decentralized Finance (DeFi)

Introduction to DeFi

Decentralized finance makes reference to non-custodial financial products and services that have been built on top of decentralized blockchain networks. DeFi is based on these pillars:

- Decentralized

- Programmable

- Permissionless

- Composable

As we have mentioned above, DeFi is decentralized because it is built on top of blockchain networks that are not centralized. It is also programmable due to the way in which it is powered. Smart contracts help deliver services to users and companies.

The DeFi market is also permissionless because there are no centralized authorities limiting participation in these networks. Everyone can participate. Finally, it is composable due to the way in which applications work with each other. DeFi allows for a high degree of customization.

While Bitcoin was the predecessor of the DeFi market, Ethereum was the real solution that allowed for the creation of new financial solutions in the cryptocurrency market. Ethereum with its smart contracts allowed the DeFi market to grow.

Some decentralized finance instruments include stablecoins, lending and borrowing, decentralized exchanges and automated strategies. Stablecoins are currencies that are not volatile and can be tied to the price of a fiat currency, for example, Tether (USDT).

Users can earn interest on loans given to borrowers in the market without necessarily having to go through intermediates. Furthermore, decentralized exchanges allow users to trade virtual currencies without having to go through centralized exchanges. Finally, automated strategies allow users to invest in bullish markets without having to do technical analysis.

Liquidity pools are also different kinds of decentralized exchanges. These platforms include Uniswap, Bancor or Kyber. Liquidity pools would have guaranteed liquidity at every price level, automated pricing solutions and it also allows users to become liquidity providers, which gives some rewards to investors.

What is DeFi Trying To Solve?

One of the problems that DeFi is trying to solve is the lack of financial solutions offered by the cryptocurrency market. While traditional financial companies such as banks are offering investors the possibility to earn interest on their investments, holding virtual currencies would not allow you to do so.

DeFi platforms are providing new solutions for users that want to hold their cryptocurrencies and earn interest on them. This can be done through lending and borrowing through DeFi solutions.

Another problem decentralized finance is trying to solve is related to distorted prices. For example, back in 2017 and the beginning of 2018, a large number of tokens skyrocketed due to the large demand there was from investors to get exposure to the crypto market. However, the only way to get exposure to crypto was to buy the assets themselves. This led to a massive bubble that ended up with most of these tokens disappearing. Decentralized Finance is helping the cryptocurrency market to get better pricing information thanks to the implantation of derivatives.

Finally, DeFi is allowing the cryptocurrency market to expand their investing possibilities. Users holding Bitcoin and other altcoins can now certainly invest their virtual currencies in a large number of solutions provided by the expansion of the DeFi market.

Finally, DeFi is allowing the cryptocurrency market to expand their investing possibilities. Users holding Bitcoin and other altcoins can now certainly invest their virtual currencies in a large number of solutions provided by the expansion of the DeFi market.

Lending and Borrowing

Lending and borrowing is one of the hot trends that is expanding in the Decentralized Finance (DeFi) market. There are several DeFi platforms that are currently lending funds to other people and generate interest. These platforms allow normal people that hold cryptocurrencies to deposit their funds, which are later lent, and receive interest when maturity is reached.

Let us give you an example. There are many cryptocurrency investors that are currently holding their funds in their wallets without receiving any income. They are just sitting there waiting for the price to move higher. With lending platforms, users can deposit their crypto holdings and earn interest on these funds.

How does this work? Simply by lending the funds to borrowers that are searching for crypto loans. Borrowers can simply need cash or another virtual currency but they do not want to sell their digital assets. This is why they deposit their holdings in the lending and borrowing platform and use these funds as collateral to take a loan.

It is also worth pointing out that there are custodial and non-custodial platforms offering lending and borrowing services. Custodial platforms are those that centralize their operations and work in a similar way to a bank. For example, one of these platforms could be a crypto exchange.

Non-custodial or decentralized platforms allow you to borrow and lend funds without having to use more than your cryptocurrency ERC-20 wallet. Exchanges and custodian solutions would require a formal sign-up. Instead, non-custodial platforms such as Compound or Yearn.Finance, do not require you to do a formal sign-up.

How Interest is Earned in Decentralized Finance

The first thing you need to take into consideration is that different DeFi platforms offer different interest rates and maturity dates. For example, you can find DeFi platforms offering 3% annual interest rate in a cryptocurrency with flexible maturity rates. Other platforms may offer 5% interest rate on fixed-term deposits of virtual currencies.

If you are an investor that wants to have clear information about your investments, for example, the date in which your investment expires, then fixed-term investments in these platforms are going to be a good option. Instead, flexible solutions would allow you to withdraw your funds at any moment but will also offer you (generally) lower interest rates for your digital assets.

Decentralized platforms are not using fiat currencies but ERC-20 tokens. You can use your stablecoins if you want to reduce your exposure to volatility. Interest rates are going to be determined by a large number of factors including:

- The type of cryptocurrency you use (not all the cryptocurrencies offer the same yield)

- Whether you are investing in a fixed or flexible solution (flexible solutions tend to offer lower returns)

- The platform you are using (some centralized platforms have hidden commissions compared to DeFi solutions)

- The demand for an asset (the higher the demand for an asset, the larger the return on your investment if there is not enough offer)

There are other issues to take into consideration. Liquidity is also an important factor. This is why decentralized platforms use interest rates to find an equilibrium between borrowers and lenders.

Which Coins Should I Lend or Borrow?

Before deciding which coins you should lend or borrow, you need to have a clear idea of your goal and what it is you are looking for.

For example, let’s say that you have $100,000 in cash and interest rates in your country are close to zero. You know that using DeFi services you can make as much as 7% or even 12% in some cases per year. However, you do not want to get exposure to crypto volatility (investing in Bitcoin (BTC) or other cryptocurrencies). In this case, you can buy a stablecoin such as Tether (USDT). You can then send the funds to a DeFi platform you like and get a higher interest rate compared to your local bank. Due to the fact that stablecoins are tied to the price of fiat currencies, you will not need to worry about Bitcoin falling.

You can also use your digital assets (Bitcoin, Ethereum, Litecoin and others). If you are a long-term crypto holder, you can simply place your funds in these DeFi platforms and start earning interest on the funds you hold. However, take into consideration that there are risks related to lending and borrowing.

How and Where to Buy Cryptocurrencies?

There are different exchanges all over the world. Most of them offer you the possibility to buy and sell Bitcoin (BTC) and some other cryptocurrencies. While some platforms have a large range of coins available, many other platforms do not have a large selection of virtual currencies.

Binance is one of the largest cryptocurrency exchanges currently available. You can create an account there, deposit funds and buy digital assets. You will also be able to enjoy many of the other solutions provided by this platform.

If Binance is not available in your region, you can go to your local exchange, buy Bitcoin and get access to platforms that are selling altcoins for BTC. For example, let’s say that you are in a region where you do not have access to Binance to buy DeFi tokens. You can simply buy crypto from your local exchange (let’s say Bitcoin or Ethereum) and transfer these coins to another platform that would allow you to get DeFi tokens. There is no cryptocurrency exchange in the market that would allow you to buy all the tokens and digital assets in the world.

Due to different regulations and platforms, there will be many different possibilities depending on the region you are living in. Nonetheless, remember that owning Bitcoin would open doors to buying tokens and assets in different platforms that may be available in your country, but do not offer fiat on-ramp solutions.

If there are no exchanges in your region, you can always use P2P exchanges that would allow you to get access to the cryptocurrency market. If instead, you want to get a cryptocurrency that is not available in your local exchange, you can always buy BTC or ETH, send it to an international platform and exchange it for another token.

Stablecoins – How to Avoid Crypto Volatility

Stablecoins are very important for users in the DeFi market. Stablecoins, as we explained in previous guides, are virtual currencies that have a relatively fixed value. In general, stablecoins are tied to the price of fiat currencies such as the U.S. dollar and the Euro, among others. However, each stablecoin is unique and different from others. Not all of them work in the same way, and this is going to have an impact on your investment portfolio.

Tether (USDT) is the top stablecoin, but this is also the most controversial among the stablecoins in the market. Some analysts suggested that the amount of USDT in the market was higher than the amount of USD held in bank accounts. Each USDT should be backed by $1 USD or equivalent. At the same time, it was also suggested by some experts that USDT was used to sustain Bitcoin’s price during bear markets. Thus, there are some risks involved in this virtual currency.

Another coin is Paxos Standard (PAX). PAX was created to help financial companies to integrate virtual currencies into their platform. This coin can be used to move money around or even to get protected against volatility in the cryptocurrency market.

USDC, also known as USD Coin, is one of the most regulated stablecoins in the market. This virtual currency is very transparent and has a wide range of use cases. Compared to Tether, it is possible to have more information about the funds that the company is using to back the USDC in circulation and to be sure the issuing of USDC follows U.S. standards.

Finally, DAI is a prominent stablecoin. This coin is not backed by the US dollar but instead, it is backed by ERC-20 currencies. This system implemented by DAI allows creating a stable price of this virtual currency without backing it with fiat currencies, but instead, using other virtual currencies.

Risks & How to Protect Your Investment

DeFi is a relatively new trend in cryptocurrencies. Nevertheless, there are some risks related to DeFi. The first risk is related to volatility. For example, let’s say that you invested 10 ETH in a DeFi platform that offered you an annual interest rate of 10%. At the end of the year, you will have 11 ETH. Although your ETH balance grew, you may have lost in USD terms. When you invested your first 10 ETH, the price per ETH was $1,000. That means that you had $10,000. Now, after a year, you have 11 ETH but its price is $400 per coin, meaning that you will have $4,400. In this case, we see how the interest rate was not enough to compensate for the losses generated by the volatility experienced by this virtual currency.

Another risk is related to the coin itself collapsing. Thus, if you are using relatively new coins or if the coin you hold went out of business, you are likely to lose all your funds. This is why it is always important to reduce your exposure to just one currency by diversifying your portfolio.

Third, using custodian platforms such as centralized exchanges could be risky. The platform itself can get hacked or attacked. If that happens and the company does not have enough funds to cover the losses, we could lose our investment. Diversifying your funds across different platforms could also be a good idea.

Analyzing the platforms you use is a key thing. You should understand who is the custodian in the platforms you use and whether they have insurance on the funds they hold. Finally, licenses are also important. If these firms are registered in traditional and regulated countries you could be sure they are working in order to offer better services and products. That being said, risks exist and should be always taken into consideration.

Best Platforms to Lend

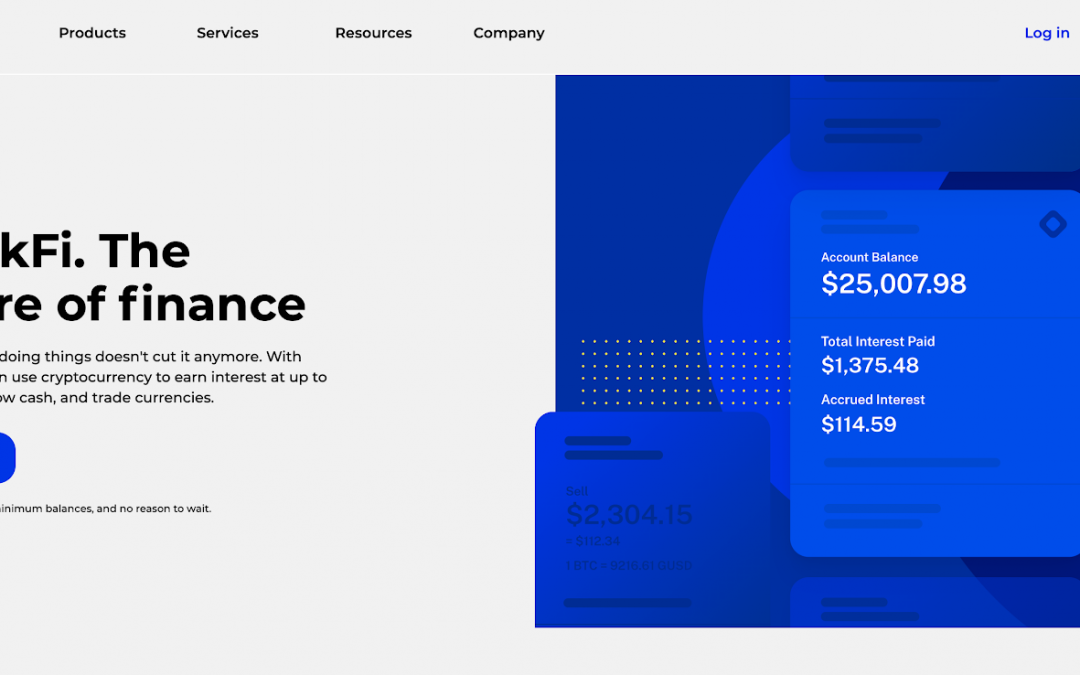

BlockFi is one of the most useful platforms that would help you to handle a wide range of decentralized finance products. The company is currently regulated in the United States and it is considered to be a legitimate firm.

With this platform, you can start earning interest on your cryptocurrency holdings. That means that you can hold your virtual currencies and still make profits with them.

You can also exchange different virtual currencies, which would allow you to balance your portfolio if you decide it is time to re-allocate some of your funds in other cryptos. The primary custodian of the funds of this platform is Gemini, one of the most recognized crypto exchanges in the world.

This platform can help you take a loan or borrow funds to the platform to give them as a loan to other users. At the moment, the team behind this platform is offering 6% APY on Bitcoin deposits, 8.6% APY on GUSD deposits and 5.25% on ETH deposits. You can also deposit USDC and receive an estimated APY of 8.6% per year.

If you want to start using this platform you will have to create an account and start depositing funds. You can select Bitcoin, stablecoins, Litecoin and many others. You can withdraw your funds to your wallets at any moment once you request to withdraw your crypto.

Compound Step by Step Tutorial

Compound is one of the largest DeFi platforms in the world. The main benefit of this platform is that it is decentralized and it is not going to be working as the custodian of your funds. Moreover, you will be able to login to your account just by using your wallet address. However, take into consideration that you must control the private keys to your wallet. If you lose these private keys, then you would not be able to get access to your funds again. You can use any wallet you want to use, including the Ledger Nano X or S. Another risk related to Compound is that it can get hacked and it may negatively affect your funds.

The platform handles coins that are based on the Ethereum platform (ERC-20). The reason behind this is related to the fact that Compound runs through smart contracts on top of Ethereum. Compound works in a very similar way to BlockFi but the main difference is related to the custody of the coin and how each of these platforms has been built. As we mentioned before, Compound is a decentralized platform that does not hold your coins, you are always holding your digital assets through your wallets.

BlockFi, instead, works as a centralized and regulated platform offering borrowing and lending services to crypto users around the world. It will be up to you to decide which is the platform you prefer to use. Remember that a non-custodial platform would allow you to keep your coins under control while custodial platforms would be in charge of your funds.

How to Store USDC on Ledger Nano Wallet?

USD Coin (USDC) is one of the most used stablecoins in the cryptocurrency market. As we have shared with you in previous guides, this virtual currency has its value pegged to the U.S. dollar (USD).

Many of USDC holders have their coins stored in Binance. However, it is always good to store our funds in a crypto wallet such as the Ledger Nano S where we can be sure we are in full control of our digital assets.

First of all, you should connect the Ledger Nano S / X to your computer and open Ledger live. This will allow you to see your coins and portfolio. If you do not have USDC already stored in your Ledger wallet, then you should create an Ethereum wallet through the Ledger live platform.

Every single coin that is built on top of Ethereum can be held in Ethereum wallets. These ERC-20 tokens include Tether (USDT), Ether (ETH) and also USD Coin (USDC). That means you will be able to withdraw your USDC funds from Binance to your Ethereum wallet in your Ledger.

In Binance, you will have to open the withdrawal screen of your USDC where you will be able to paste the wallet address where you want to receive the funds. In your Ledger live application, go to your Ethereum account and click on receive coins. This will show your wallet address that will have to be pasted in Binance.

Nexo Finance

Nexo is a borrowing and lending centralized platform licensed in the European Union (EU) that is offering crypto investors the possibility to deposit their funds and earn interest on their coins. Nexo claims that it has already offered services to more than 800k clients and that they have $100 million insurance on all custodial assets.

This information is very valuable considering you can be sure the company is taking care of users’ funds. Despite that, you should always do your own research and analysis before investing virtual currencies in any of the platforms offering services.

Nexo has also created its own cryptocurrency and it is also accepting fiat deposits. Furthermore, this platform is available in over 200 countries all over the world. It is worth taking into consideration that you can use the Nexo Card to spend your funds, including cryptocurrencies and fiat assets.

In this platform, you will be able to select the cryptocurrency or fiat currency that you want to deposit and start earning interest on it. Furthermore, if you hold the NEXO token, you will be able to earn additional rewards just for holding this digital asset.

The interesting thing about this platform is that it offers instant payments. If you have enough collateral, you can instantly borrow funds. Nexo is also offering a calculator that would help you understand which could be your interest if you deposit funds in the platform. Finally, you will also be able to check information about Nexo’s credit lines to those users that want to borrow funds.

Metamask Step by Step Tutorial

Metamask is one of the greatest cryptocurrency wallets currently available in the market. The main characteristic of this wallet is that it is embedded in your web browser. This wallet is specifically used to process micro and small transactions in the crypto market and on different platforms.

Considering this is a wallet that supports ERC-20 tokens, you can interact with a wide range of decentralized applications (dApps) and also decentralized finance (DeFi) solutions. Users can use it with Compound, MakerDAO, Uniswap and many other firms and platforms.

The Ethereum wallet address that you will have with Metamask will be interacting with all the systems and applications that are based on the Ethereum network. This makes it easier for users to get access to the blockchain space and to find new investment opportunities using cryptocurrencies.

If you want to start using Metamask you only need to go to the official site of this wallet and download the wallet. The instructions will be shown as soon as you download it and setting it up is very straightforward.

We always recommend investors and readers to safely store their seed phrase and private keys, this would allow you to get access to the wallet in the future if you lose access to it.

Decentralized Exchanges

Decentralized exchanges are crypto platforms that allow users to exchange virtual currencies without depending on a centralized authority. That means that if you are buying a token from another user you would be able to do so without having to interact with a centralized company such as Binance or Coinbase.

The decentralized exchange would only be providing the interface for you to buy or sell tokens. There is no authority regulating which transactions are processed or controlling your funds.

When we use a centralized exchange, we are using these platforms as if they were banks. We need to go through KYC verification and provide our private data. Decentralized exchanges do not require you to sign up and you don’t need to send any picture of your ID as it usually happens with centralized platforms in the cryptocurrency market.

Users can get access to decentralized exchanges by using their wallets, including Ledger Nano S / X or Metamask, among others. That means that you will have more privacy using decentralized exchanges. When using one of these platforms, you will only be represented by your public address, no one would be able to get your information.

At the same time, you will be controlling and handling your coins at all times. Decentralized exchanges are non-custodial platforms, compared to traditional centralized exchanges that keep custody of your coins.

Decentralized exchanges are also great to find new and small-cap coins that may have the potential to grow in the future. While centralized platforms have strict processes to add new coins to their platforms, decentralized exchanges do not control which coins are traded. Users and developers themselves can upload their coins without asking for permission to a centralized authority.

The main disadvantage of decentralized exchanges is related to not being able to complain about the services or ask for customer support. If you lose your password or something goes wrong with this platform, then it may be difficult to get help. By using centralized exchanges you get access to dedicated customer support.

Additionally, other disadvantages are related to the lack of easy-to-use interface, liquidity, and slow services compared to traditional centralized exchanges.

Uniswap Full Tutorial

Uniswap is a decentralized exchange that became famous in recent months due to the expansion of the Decentralized Finance (DeFi) market. In order to use the platform, you only need to have a wallet and some Ethereum (ETH) coins if you want to pay for the gas fees.

Uniswap is working on top of Ethereum and it works with Metamask and many other wallets, including Ledger Nano S / X. If you are using Uniswap, you will be able to swap different coins.

For example, if you want to buy REN, you will be able to select the amount of ETH you want to spend. Automatically after, you will be able to see the amount of REN that you are expected to receive. Once you confirm the transaction, the swap will be processed and you will have your REN ready to be used.

Then, you will be able to exchange your REN for other virtual currencies. For example, you can exchange your REN for DAI. You will have to select the coin you have and the coin you want to receive.

Slippage tolerance refers to how much fees you are willing to pay for the transfer to be confirmed by the network as fast as possible. Take into consideration that smaller fees would end up creating slower transactions. The Slippage is usually 0.1% but you can change it, meaning that you are willing to pay 0.1% of your trade (or more) in gas fees

If you activate the expert mode, you will be able to select ENS names and other wallets. Nonetheless, if you are a basic user, the best thing you can do is to use the basic solution.

For you to understand what slippage is, let’s use a simple example. Let’s say you wanted to buy a token for $1. When the trade executes at this price, it may not match the price you selected while placing the buy order. In order to avoid unwanted problems, Uniswap added a percentage that is shown as ‘Slippage Tolerance.’ This would allow you to buy an asset knowing that the price will not be very different from what you wanted it to be.

Ecosystems

Protocols and ecosystems are very important for the cryptocurrency and decentralized finance markets. At the moment, most of the new DeFi solutions are working on top of Ethereum, meaning that you may not use non-ERC-20 tokens on these platforms.

Each product and platform on the DeFi market is built on top of a blockchain network. As we mentioned before, most of these platforms are built on Ethereum. Other popular blockchain networks include Tron (TRX) or EOS.

If you are using a decentralized exchange you will not be able to directly use Bitcoin. Bitcoin has its own blockchain network and no decentralized exchange is supporting BTC right now. Although you can use Wrapped Bitcoin (wBTC) and other Bitcoin derivatives and tokens, you are not using BTC.

All the tokens that run on the Ethereum network are called ERC-20 tokens. These coins include Tether (USDT), USD Coin (USDC) and many others. Only tokens that have been built on top of the Ethereum ecosystem will be supported by these platforms.

The same will happen with Tron-based platforms and decentralized applications (dApps) working on top of Tron. If you want to use this ecosystem, you will need to have TRX or other Tron-based currencies that would be supported. BitTorrent Token (BTT) is one of the most popular tokens on the Tron network.

Yield Farming and Liquidity Mining

One of the main goals of decentralized finance (DeFi) is to provide liquidity in a decentralized way. When we use a traditional centralized platform, we find that there are thousands of users willing to sell and buy cryptocurrencies. But decentralized exchanges work in a different way.

The challenge with decentralized finance is that the money that these platforms have comes from users in the cryptocurrency world. This is where yield farming and liquidity mining come into place.

Yield farming is related to investors searching for the best protocols and platforms offering a higher yield for lending. These platforms offer users the possibility to deposit funds and earn interest on them. Nevertheless, interest rates change from platform to platform.

Now let’s suppose that a trader wants to exchange its DAI for Ethereum (ETH). When the trade is processed, a part of the fees paid is distributed among those liquidity providers (users that deposited their funds to earn interest). The higher the participation in the trading pool (ETH/DAI), the higher the rewards.

Some of the most popular protocols include Uniswap, Compound or Synthetix, among others. The yield is accumulated on a daily basis and distributed it every single day. Some decentralized crypto exchanges could use the liquidity provided by these pools in order to provide traders with the coins they want to trade.

Liquidity mining is an activity that can be conducted by investors in order to provide liquidity and get paid for these services. However, instead of being rewarded with the coin they have deposited, they will get another virtual currency.

Liquidity Mining on Uniswap

As we mentioned before, liquidity mining would allow you to earn digital currencies of certain protocols by providing liquidity to these pools. For example, you can stake Ethereum (ETH) and earn rewards in UNI and other currencies.

You can use the Uniswap protocol where you can connect it to your cryptocurrency wallet, including Metamask and Ledger Nano S or X. The first thing you will do is to assign the funds into a liquidity pool and then we can select the number of tokens we want to supply to this pool.

After this, you will be able to receive the UNI coins that are provided by the platform. Liquidity mining can be performed on different platforms, not only in Uniswap.

Due to the fact that we are using a decentralized platform, you may have to perform several transactions. This is going to cost some money, depending on the gas fees on the Ethereum network. Nevertheless, there are periods with lowers gas fees than others.

If you are planning to do liquidity mining, take into consideration that you should keep your stake for several days and weeks if you want to make some more money than just a few dollars or cents.

Decentralized platforms are usually less user-friendly than centralized platforms but take into consideration that you are going to be the real owner of your funds. While centralized platforms can be very comfortable to use, they keep custody of your funds.

Liquidity Mining on JustSwap

JustSwap is the Tron (TRX) based decentralized exchange that is currently a competitor of Uniswap on the Ethereum (ETH) network. As in the Ethereum ecosystem, you would need Metamask in order to get access to Uniswap, on the Tron network, we will use the TronLink Wallet to use JustSwap, which is going to be working as an extension in your web browser.

By using JustSwap, you will be able to exchange Tron-based digital assets. Take into consideration that Tether (USDT) is already available on the Tron network. You can swap your TRX into USDT (TRX-based) and other virtual currencies.

However, you can also provide liquidity in TRX coins and mine other virtual currencies such as SUN. In order to do so, you will have to deposit your TRX in the SUN/TRX pool and retrieve rewards.

To find the different pools available on JustSwap, you will have to select the “Pool” menu on the top of the screen. Once you are there, you will only need to “Add liquidity” to the desired pool.

Once you deposit the funds, you will receive staking tokens that can be later deposited into the SUN/TRX pool. To do so, you have to open SUN.io page, select the pool you want to use, and deposit the stake you acquired (SUN and TRX) and you deposit the funds. This would allow you to earn rewards on your stake.

How to Unstake and Claim Rewards on SUN.io?

If you had a stake in a SUN.io pool, then you will be able to unstake your funds and claim rewards. This is going to be a very straightforward process that shouldn’t create issues. In order to claim your funds, you should go to the official site of SUN.io and click on Claim & Unstake button.

The Claim & Unstake button is located in each of the pools where you have been staking your funds. You will need to wait for a confirmation in the network and the transaction will be submitted on the TRON network.

If you go to your official TronLink wallet, you will see the liquidity pool token you have received. Now, you need to swap this token using the process we have shared before. You go to JustSwap, you select the liquidity pool token, and you can exchange it for another Tron-based currency, including TRX or USDT.

Setting Up Binance Smart Chain Wallet

The Binance Chain wallet is a crypto wallet for the Binance Chain, Binance Smartchain and Ethereum. These are different three networks with different tokens and functionalities. You can interact with your Binance tokens using your Metamask as well.

If you go to Metamask, you will be able to expand the view, go to your profile, setting and select the Networks section. When we use Metamask, we usually work with Ethereum. However, we can follow the information provided by Binance on its official site.

Once you complete all the information, you can select connect to Binance Smartchain. This is going to show your Binance Smartchain value in BNB. Now you can keep your BNB in Metamask and interact with a wide range of Binance solutions, including DeFi solutions or Binance DEX.

TronLink Wallet Tutorial

TronLink Wallet is one of the most useful wallets to get access to the Tron (TRX) decentralized ecosystem. This wallet will be embedded into your web browser, making it very useful to get connected to decentralized applications (dApps) and the decentralized finance (DeFi) market.

This wallet will definitely be useful to mine, for example, the recently launched Sun Token (SUN). Before you start, be sure to be using the right TronLink Wallet link to avoid phishing sites and other scams.

That being said, if you want to use the TronLink Wallet then you will have to add the extension to your browser. You can use Brave or Chrome, both of them will work properly with this wallet. Once you download it, you will be able to create a new wallet account.

Remember that you should keep the information provided by your wallet. That includes the mnemonic phrase that will be given to you during the setup process. Once this is done, you will be able to use your wallet. If you lose the mnemonic phrase, you will not be able to get access to your funds if you lose your wallet. Take that into consideration.

You will be able to transfer your TRX tokens to your wallet and use it to get some exposure to the DeFi market. The wallet will be very useful to store not only TRX but also many other Tron-based tokens.

Binance Masterclass – DeFi Edition

Binance is one of the most useful platforms to leverage and use in the decentralized finance market. While traditional finance allowed large investors to make profits just by depositing their money into bank accounts, decentralized finance is allowing everyone to use their digital currencies to earn interest.

As we have seen in previous guides, the DeFi market is allowing for unique opportunities. That includes yield farming and liquidity mining. If you have an account on Binance, you would not need to go through all the DeFi protocols out there, but the exchange would offer you access to a wide range of products and services.

In the Liquid Swap page of Binance, you will have the possibility to deposit funds (including USDT) and provide liquidity to different pools. You will be able to earn profits just by providing liquidity to this pool. Although there are risks, this could be one of the best ways to get access to passive income in virtual currencies.

Liquidity mining can be a good way to earn new tokens. This can be done through the Launchpool offered by Binance. Instead of getting rewards in the currency you used to provide liquidity to a specific liquidity pool, you will get rewards in a different cryptocurrency or token for providing liquidity to this specific pool.

Let’s say you deposited 1,000 USDT in the liquidity pool shown before. Then, at the end of the year, you are expected to earn interest on your USDT coins (the interest can fluctuate throughout the days), which is going to be paid in USDT. By providing liquidity to mining pools (liquidity mining), you will be receiving the rewards in a different token rather than in USDT. This would allow you to get early access to a token that may not be available for trading and that could increase its value in the future. Binance allows you to get access to these DeFi systems.