With the U.S. elections around the corner, speculations around Bitcoin’s price trajectory are at an all-time high. Many investors are asking, “Could Bitcoin reach $100k after the elections?” While there is no crystal ball to predict with certainty, several factors could influence Bitcoin’s price as political outcomes unfold.

Historical Performance and Election Cycles

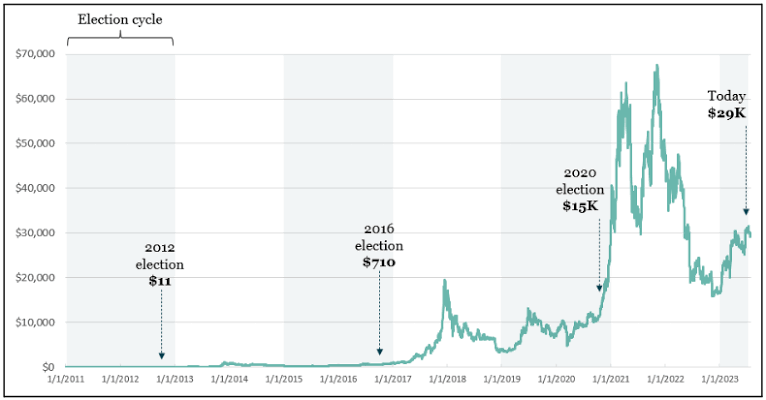

Historically, financial markets often react to political changes, and Bitcoin is no exception. For example, after the 2020 U.S. election, Bitcoin surged to new highs, reaching almost $65k by April 2021. However, Bitcoin’s price also dipped sharply following that peak.

Election cycles bring new economic policies, which can affect market sentiment. A favorable regulatory environment and economic stimulus packages could spark more institutional interest in Bitcoin, driving the price toward $100k. Alternatively, stricter regulations might dampen enthusiasm.

Bitcoin Price Over Time

Source: CoinMetrics.

Election Outcomes and Predictions

According to recent analyses, the outcome of the U.S. elections could have a substantial impact on Bitcoin’s price trajectory. Standard Chartered predicts that if Donald Trump wins the election, Bitcoin could surge to $125,000 by the end of 20241. This optimistic forecast is based on Trump’s pro-crypto stance and his promises to eliminate federal crypto regulations, which could create a more favorable environment for digital assets1.

On the other hand, if Kamala Harris wins, Bitcoin is still expected to perform well, albeit at a more moderate pace. Standard Chartered estimates a price of around $75,000 by year-end under a Harris presidency1. Harris is seen as more open to crypto than the current administration, which could still lead to positive regulatory changes, albeit at a slower pace

Factors Influencing Bitcoin’s Price

Several factors will influence Bitcoin’s price post-elections:

1. Regulatory Environment:

The regulatory landscape is a critical factor. A more relaxed regulatory environment under a Trump presidency could boost investor confidence and drive prices higher. Conversely, a slower but positive regulatory change under Harris could still support a bullish trend1.

2. The Role of Inflation and Federal Reserve Policies

Another critical factor post-election is the U.S. Federal Reserve’s stance on inflation and interest rates. If inflation continues to rise and traditional fiat currency weakens, Bitcoin could become an attractive hedge against inflation. With more institutions and individuals looking for alternatives to protect their wealth, Bitcoin could experience upward pressure.

On the other hand, if the Fed takes aggressive action to curb inflation by raising interest rates, this could result in a tightening of liquidity in the financial markets, potentially slowing Bitcoin’s rise.

3. Institutional Investment Surge

The growing interest from institutional investors is another key indicator of Bitcoin’s potential to reach $100k. Large corporations such as MicroStrategy, Tesla, and Grayscale have invested heavily in Bitcoin over the past few years. Should the election results foster a favorable business climate and policies supporting digital assets, more institutional players may enter the market, leading to higher Bitcoin prices.

Moreover, the approval of a Bitcoin Spot ETF, which is a major topic among financial regulators, could act as a catalyst for Bitcoin to surge past $100k. Many analysts believe that if such a financial product becomes available, it will attract trillions of dollars into the market.

4. Market Sentiment and FOMO

In the crypto world, market sentiment and FOMO (Fear of Missing Out) play a significant role. Positive news, political developments, or a series of institutional investments after the elections could trigger FOMO, leading to a sharp rise in Bitcoin’s price.

Should Bitcoin approach its previous all-time highs of $65k, the psychological barrier of $100k could come into play. Speculators and traders may push the price further, driven by the belief that Bitcoin will hit the $100k mark soon.

5. Global Economic Conditions

While the U.S. elections are a major event, global factors also influence Bitcoin’s price. For instance, geopolitical tensions, energy crises, or significant economic shifts in other parts of the world could drive investors to seek safe-haven assets like Bitcoin.

A recession or economic slowdown in major markets could also prompt more investors to look toward decentralized currencies as an alternative to traditional investments. Conversely, strong economic recovery and high stock market performance post-elections may reduce Bitcoin’s attractiveness, slowing its price climb.

Conclusion: Is $100k Possible?

While predicting exact price movements is challenging, the consensus among analysts is that Bitcoin is poised for significant gains post-elections, regardless of the outcome. The potential for Bitcoin to reach $100,000 or even higher is supported by favorable regulatory prospects, market sentiment, and broader economic conditions.

Investors should stay informed and consider these factors when making investment decisions. As always, it’s essential to conduct thorough research and consult with financial advisors to navigate the volatile cryptocurrency market.

What are your thoughts on Bitcoin’s future? Do you think it will hit $100,000? Feel free to share your opinions in the comments below!

If you’re looking to capitalize on Bitcoin’s price movements and other cryptocurrency opportunities, CoinW is the platform for you. With its user-friendly interface, secure trading environment, and competitive fees, CoinW offers the perfect place to trade Bitcoin and other top cryptocurrencies. Don’t miss out on the chance to grow your portfolio in a thriving market.

Sign up on CoinW today and start trading! Join CoinW now to take your crypto investments to the next level! and Telegram group for free signals!!

Disclaimer:

The information provided in this blog is for informational purposes only and should not be construed as financial advice. Cryptocurrency investments are highly volatile and carry significant risks. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or gains incurred as a result of the information provided in this blog.