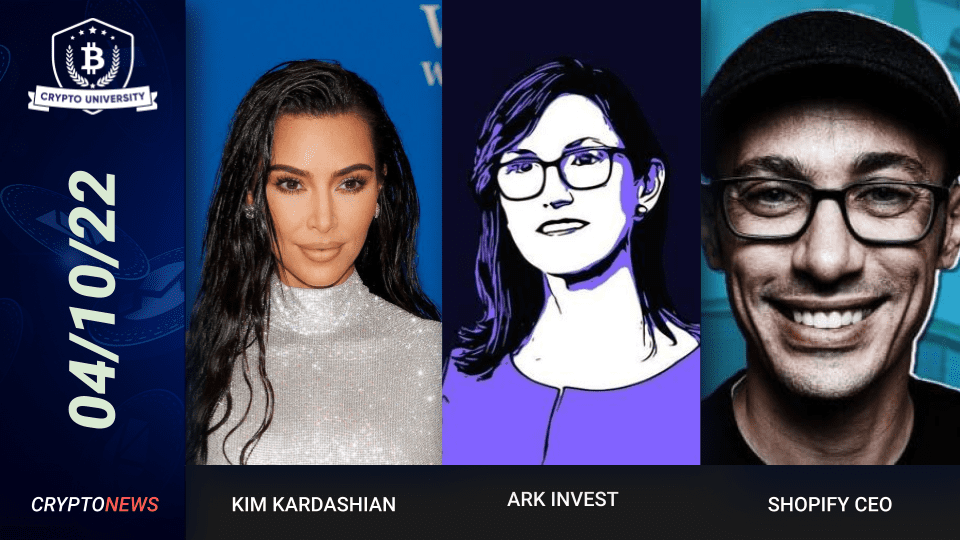

Kim Kardashian Fined $1.26M By SEC

Kim Kardashian, the famous reality tv star, received a $1.26 million fine from the SEC yesterday. The SEC found her guilty for touting EthereumMax, a cryptocurrency, on social media. The SEC is charging her for failing to disclose a $250 000 payment she received from the company in exchange for her promotion post.

“This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto-asset securities, it doesn’t mean that those investment products are right for all investors,” said SEC Chair Gary Gensler.

The SEC encourages investors to consider potential risks and opportunities in light of their financial goals. And blindly follow by the opinions of others. The law also requires celebrities to disclose when they receive payment for promotional posts.

Ark Investment Partners With Eaglebrook Advisors

Ark Invest, an asset management company, has partnered with Eaglebrook, a digital asset SMA platform. Eagle Brook is known for its investments in cutting-edge technology, and Ark Invest will provide cryptocurrency strategies to registered investment advisor customers.

“We have a pipeline of large asset managers, but will stagger these launches to ensure the success of each asset manager launch. We are looking to work with any sophisticated asset manager looking to move into the crypto space and be the technology platform to launch their products,” he Eaglebrook CEO Christopher King.

The cryptocurrency strategy of asset management primarily invests in bitcoin and ether. Ark’s Crypto Asset Strategy aspires to invest in the top ten or twenty currencies associated with smart-contract networks, DeFi, and Web3, as well as infrastructure and scalability. The SMAs will be available on October 17.

Shopify CEO Buys Coinbase Stock

Tobias Lütke, the CEO of Shopify, spent $3M on Coinbase stock in two months, accumulating more than 40 thousand shares. According to his SEC filings, the e-commerce billionaire bought 369 000 Coinbase per week since August.

“Coinbase is still in the grips of recent issues, including SEC action, technical issues, terrible financial metrics (huge negative EBITDA), and fee structure,” Oisin Maher, founder of QuantX Analytics, said.