The last few years have been highly volatile for the cryptocurrency market, giving a lot of early investors huge profits and trapping panic buyers in price levels we won’t be visiting for a while. Many people ask “what is a bull market”, a term many traders and investors are familiar with and this article will address the most important aspects of this market cycle.

What is a bull market?

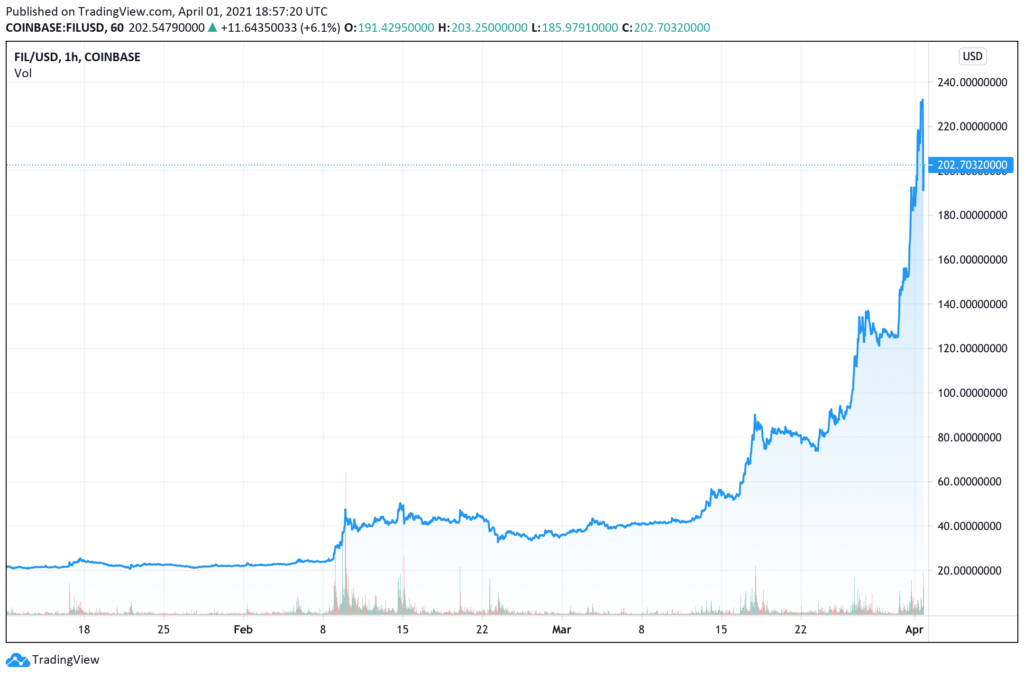

A bull market (also called bull run) is a market cycle where demand is higher than supply, pushing prices to higher levels. Bull markets are more than a price spike, as they can last for months without a significant pullback.

This cycle can be caused by positive news or events involving a specific market. In the case of the cryptocurrency market, the “Bitcoin halving” has an impact on Bitcoin’s price, influencing altcoins and low-capitalization assets. Bitcoin is currently the biggest cryptocurrency in the market and has a strong dominance over other coins.

How to get in a bull market?

To make the most of a bull market, investors need to know the right time to buy, and that is during bear markets and pullbacks. Buying assets at a discount makes your gains even higher when prices reach supply zones and beyond.

Bull markets take place after the accumulation period, which happens when a bearish trend comes to an end.

It is imperative to study the asset’s price in a long-term timeframe to fully understand the long-term scenario and how cycles behave.

When is the right time to sell?

When a bull market has been going for a while and assets are overpriced, some key resistance levels stop the price from going up and push it down, making lower highs and higher lows. This market structure is a clear signal to take your profits, considering prices will start going down towards lower support levels.

Bull markets are known for giving investors huge gains and affecting their emotions, so they have to stick to an investing plan to know exactly when to sell their holdings.